SCHD Dividend History is a key topic for anyone looking to invest in dividend-focused ETFs. SCHD, or the Schwab U.S. Dividend Equity ETF, is well-known for providing regular income through dividends while tracking high-quality U.S. companies. By exploring schd dividend history, investors can see patterns in payouts, understand how consistent the ETF has been over time, and make informed decisions about their investment. Dividends are an important part of long-term wealth building, and knowing the history of SCHD dividends can help you plan for future income streams. Whether you are a beginner or an experienced investor, learning about schd dividend history will give you confidence in your portfolio choices. It is not only about the numbers but also about understanding how SCHD selects companies that have strong dividend records and financial stability, which can make a big difference in your investment strategy.

Looking deeper into schd dividend history can reveal trends that help investors decide when and how much to invest. SCHD focuses on companies with strong fundamentals and a history of paying consistent dividends, which makes it attractive for those seeking passive income. By reviewing the past dividend payments, you can identify patterns, such as quarterly payouts, increases in dividends, and periods of stability. Investors can also compare SCHD’s dividend history with other dividend ETFs to see how it performs over time. Understanding schd dividend history is not just about the past; it helps predict future performance and allows you to align your investment goals with your income needs. Moreover, knowing the history can help you manage taxes, reinvest dividends effectively, and maximize returns. In short, studying SCHD’s dividend history is a smart step for anyone who wants steady income and long-term growth in the stock market.

What is SCHD Dividend History and Why It Matters

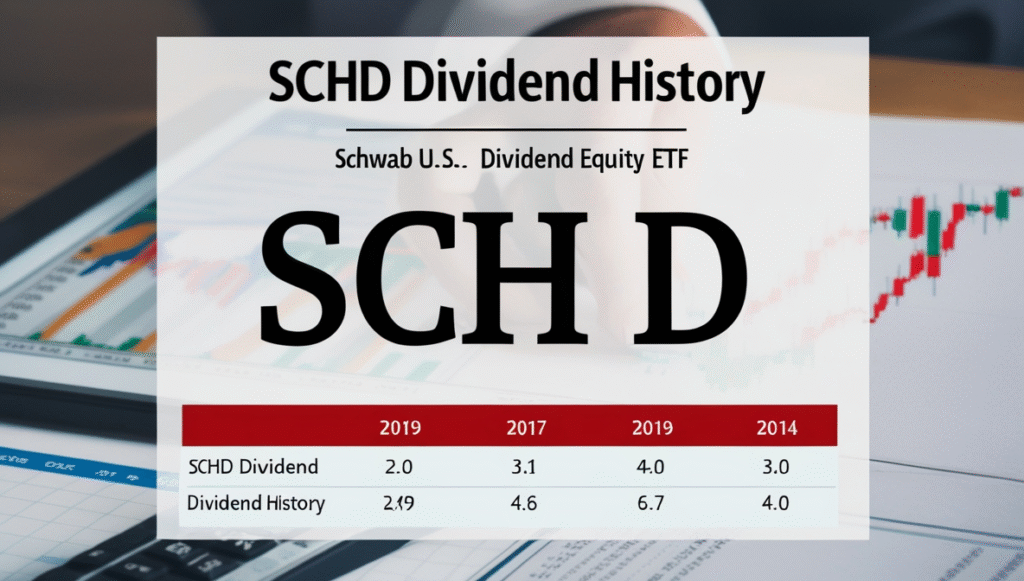

schd dividend history shows all past dividend payments made by the SCHD ETF. Investors look at this history to understand how reliable the ETF is for income. SCHD selects strong U.S. companies with a record of paying dividends, which makes it a good choice for long-term investors. The dividend history helps investors predict potential income and plan their investment strategies. A stable dividend history can be reassuring, especially for those who depend on dividend income for daily expenses or retirement planning

How SCHD Dividend History Shows ETF Income Patterns

By analyzing schd dividend history, investors can see when and how much SCHD pays. Typically, SCHD pays dividends quarterly, and many companies in the ETF increase their payouts over time. Seeing this pattern helps investors understand the income potential and predict future dividends. Patterns in dividend history also show how SCHD reacts to market changes and economic conditions. For example, during market slowdowns, the ETF may still pay consistent dividends, showing stability.

SCHD Dividend History: Key Insights for New Investors

For new investors, schd dividend history is an easy way to understand ETF income. By looking at past payments, beginners can learn how dividends grow and how to plan investments. New investors can also see the average dividend yield, which is the income percentage relative to the ETF’s price. This helps in comparing SCHD with other ETFs and deciding which one suits their goals. Studying dividend history builds confidence and encourages disciplined investing.

Comparing SCHD Dividend History with Other ETFs

SCHD is not the only dividend ETF. By comparing schd dividend history with ETFs like VYM or DVY, investors can see which ETF offers better stability or higher payouts. SCHD often stands out for consistency and quality of companies in the fund. Comparing dividend histories helps investors make informed choices and balance risk and return.

Understanding Quarterly Payouts in SCHD Dividend History

SCHD pays dividends every three months, known as quarterly payouts. Each payout can differ slightly depending on company performance and economic factors. By reviewing schd dividend history, investors can track the exact payout dates and amounts. Understanding quarterly payouts is useful for financial planning, budgeting, and reinvesting dividends. It also helps investors know when they will receive income and how it contributes to their overall returns.

How SCHD Dividend History Reflects Company Stability

schd dividend history is not only about ETF payouts but also about the stability of the companies it holds. Companies with strong financial health tend to increase dividends steadily, while weaker companies may reduce payouts. By analyzing the dividend history, investors can see which companies consistently contribute to SCHD’s income. This reflects the ETF’s ability to provide steady returns, even during economic uncertainty.

SCHD Dividend History and Long-Term Investment Planning

Investors who focus on long-term growth find schd dividend history very useful. By studying past dividends, investors can estimate future income and plan retirement or wealth-building strategies. Dividend reinvestment strategies also benefit from understanding SCHD’s history. Reinvesting dividends can compound wealth over time, and knowing when and how much dividends are paid allows better planning for long-term goals.

Tips for Using SCHD Dividend History to Maximize Returns

- Track Payment Patterns: Keep a record of dividend dates and amounts to plan reinvestment.

- Compare Yields: Compare SCHD dividend yield with other ETFs to check competitiveness.

- Monitor Company Performance: Understand which companies contribute most to dividends.

- Reinvest Dividends: Reinvesting can compound returns over time.

- Plan Taxes: Knowing dividend history helps manage tax obligations efficiently.

Common Questions About SCHD Dividend History

Many investors have questions about SCHD’s dividend payments. For example: How often does SCHD pay dividends? Are dividends guaranteed? Can dividends decrease during market drops? Understanding the history helps answer these questions and reduces investment uncertainty.

How Dividend Reinvestment Works with SCHD Dividend History

Investors can use SCHD’s dividend history to plan reinvestments. When dividends are paid, they can be automatically reinvested to buy more shares of the ETF. By reinvesting consistently, investors can take advantage of compounding. Looking at past payments helps predict future reinvestments and plan long-term strategies.

Conclusion

Understanding schd dividend history is essential for any investor who wants steady income and long-term growth. By reviewing past dividends, investors can see patterns, predict future payouts, and make smarter investment decisions. SCHD’s focus on high-quality companies with consistent dividends makes it a reliable choice for both beginners and experienced investors. Studying dividend history also helps with reinvestment strategies, tax planning, and financial stability. Whether your goal is regular income, long-term growth, or building wealth through compounding, knowing SCHD’s dividend history gives you the insights needed to succeed.

FAQs

Q1: How often does SCHD pay dividends?

SCHD pays dividends quarterly, usually in March, June, September, and December.

Q2: Can SCHD dividends decrease?

Yes, dividends can decrease if the ETF’s companies face financial challenges, though SCHD focuses on stable companies.

Q3: Is SCHD good for long-term investors?

Yes, SCHD is ideal for long-term investors seeking consistent income and potential growth.

Q4: Can I reinvest SCHD dividends?

Yes, investors can reinvest dividends automatically to buy more shares, which helps grow wealth over time.

Q5: How does SCHD dividend history help new investors?

By studying past dividends, new investors learn payout patterns, yield trends, and can plan income and reinvestment strategies.